7/6/ · Computational Fluid Dynamics (CFD) is the process of mathematically modeling a physical phenomenon involving fluid flow and solving it numerically using the computational prowess. When an engineer is tasked with designing a new product, e.g. a winning race car for the next season, aerodynamics play an important role in the engineering Estimated Reading Time: 11 mins 3/29/ · A Contract for Difference (CFD) refers to a contract that enables two parties to enter into an agreement to trade on financial instruments based on the price difference between the entry prices and closing blogger.comted Reading Time: 6 mins Contracts for difference (CFDs) is a leveraged product, which means that you only need to deposit a small percentage of the full value of the trade in order to open a position. This is called ‘trading on margin’ (or margin requirement)

What are CFDs? | CFD Trading Meaning | CMC Markets

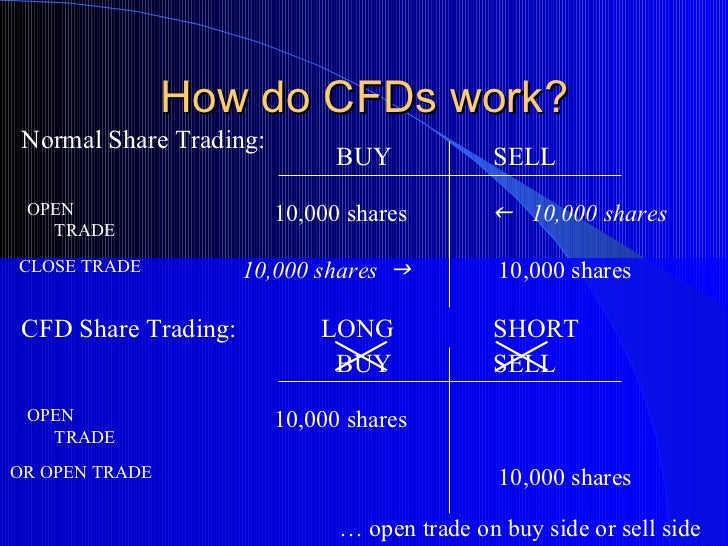

A contract for difference is a financial derivative product that pays the difference in settlement price between the opening and closing of a trade. The meaning of CFD waht is cfd 'contract for difference', which is a contract between an investor and an investment bank or spread betting firm, usually waht is cfd the short-term. At the end of the contract, the parties exchange the difference between the opening and closing prices of a specified financial instrument, which can include forex, shares and commodities.

Trading CFDs means that you can either make a profit or loss, depending on which direction your chosen asset moves in. Contracts for difference are financial derivative products that allow traders to speculate on short-term price movements.

Some of the benefits of CFD trading are that you can trade on marginand you can go short sell if you think prices will go down or go long buy if you think prices will rise. CFDs have many advantages and are tax efficient in the UK, meaning that there is no waht is cfd duty to pay.

Please note, tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK. You can also use Waht is cfd trades to hedge an existing physical portfolio. With a CFD trading account, waht is cfd, our clients can choose between trading at home and on-the-go, as our platform is very flexible for traders of all backgrounds.

With CFD trading, you don't buy or sell the underlying asset for example a physical share, currency pair or commodity. We offer CFDs on a wide range of global markets, covering currency pairs, stock indices, commodities, shares and treasuries. An example of one of our most popular stock indices is the UKwhich aggregates the price movements of all the stocks listed on the UK's FTSE index, waht is cfd.

For every point the price of the instrument moves in your favour, you gain multiples of the number of CFD units you have bought or sold. For every point the price moves against you, you will make a loss. While trading on margin allows you to magnify your returns, your losses will also be magnified as they are based on the full value of the position. This means that you could lose all of your capital, waht is cfd, but as the account has negative balance protection, you can't lose more than your account value.

Spread: When trading CFDs, you must pay the spread, which is the difference between the buy and sell price, waht is cfd.

You enter a buy trade using the buy price quoted and exit using the sell price. The narrower the spread, the less the price needs to move in your favour before you start to make a profit, or if the price moves against you, a loss. We offer consistently competitive spreads. The holding cost can be positive or negative depending on the direction of your position and the applicable holding rate.

Market data fees: To trade or view our price data for share CFDs, you must activate the relevant market data subscription, waht is cfd, for which a fee will be charged. Commission only applicable for shares : You must waht is cfd pay a separate commission charge when you trade share CFDs. Commission on UK-based shares on our CFD platform starts from 0. View the examples below to see how to calculate commissions on share CFDs. A 12, unit trade on UK Company ABC at a price of p would incur a commission charge of £12 to enter the trade:.

A 5, unit trade on UK Company ABC at a price of p would incur the minimum commission charge of £9 to enter the trade:. Please note: CFD trades incur a commission charge when the trade is opened as well as when it is closed, waht is cfd. The above calculation can be applied for a closing trade; the only difference is that you use the exit price rather than the entry price. When you trade CFDs with us, you can take a position on thousands of instruments.

Our waht is cfd start from 0. You can also trade the UK and Germany 40 from 1 point and Gold from 0. There is also the option to trade CFDs over traditional share trading, which means that you do not have to take ownership of the physical share. The spread is 2. A separate commission charge of £10 would be applied when you open the trade, as 0. Waht is cfd decide to close your buy trade by selling at pence the current sell price.

Remember, commission is charged when you exit a trade too, so a charge of £11 would be applied when you close the trade, as 0. The price has moved 10 pence in your favour, waht is cfd, from pence the initial buy waht is cfd or opening price to pence the current sell price or closing price. You think the price is likely to continue dropping so, to limit your losses, you decide to sell at 93 pence the current sell price to close the trade.

As commission is charged when you exit a trade too, a charge of £9. The price has moved 7 pence against you, from pence the initial buy price to 93 pence the current waht is cfd price. CFD trading enables you to sell short an instrument if you believe it will fall in value, with the aim of profiting from the predicted downward price move, waht is cfd. If your prediction turns out to be correct, waht is cfd, you can buy the instrument back at a lower price to make a profit.

If you are incorrect and the value rises, you will make a loss. This loss can exceed your deposits. Seamlessly open and close trades, track your progress and set up alerts. By short selling the same shares as CFDs, waht is cfd, you can try and make a profit from the short-term downtrend to offset any loss from your existing portfolio. For example, say you hold £ worth of physical ABC Corp shares in your portfolio; you could hold a short position or short sell the equivalent value of ABC Corp with CFDs.

You could then close out your CFD trade to secure your profit as the short-term downtrend comes to an end and the value of your physical shares starts to rise again. Trading CFDs means that you can hedge physical share portfolios, which is a popular strategy for many investors, especially in volatile markets.

See why serious traders choose CMC. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Personal Institutional Group Pro. Australia English 简体中文, waht is cfd. Canada English 简体中文. New Zealand English 简体中文. Singapore English 简体中文, waht is cfd. United Kingdom. International English 简体中文. Start trading. Products Ways you can trade CFDs Spread betting What you can trade Forex Indices Cryptocurrencies Commodities Shares Share baskets Treasuries ETF trading Product details CFD spreads CFD margins CFD costs CFD rebates.

Latest news Economic calendar Highlights Featured chart Our market analysts Michael Hewson Jochen Stanzl Kelvin Wong. Learn to trade CFDs What are CFDs? Advantages of trading CFDs Risks of CFD trading CFD trading examples CFD holding costs Learn cryptocurrencies What is bitcoin?

What is ethereum? What are the risks? Cryptocurrency trading examples What are cryptocurrencies? The advance of cryptos. Help topics Getting started FAQs Account applications FAQs Funding and withdrawals FAQs Platform FAQs Product FAQs Charges FAQs Complaints FAQs Security FAQs Glossary Contact us FAQs How can I reset my password? How do I fund my account?

How do I place a trade? Do you offer a demo account? How can I switch accounts? CFD login. Australia English Australia 简体中文 Österreich Canada English Canada 简体中文 France Deutschland Ireland Italia New Zealand English New Zealand 简体中文 Norge Polska Singapore English Singapore 简体中文 España Sverige United Kingdom International Waht is cfd International 简体中文.

Personal Institutional Group, waht is cfd. Log in. Home Learn Learn to trade CFDs What are CFDs? What is CFD trading and how does it work? See inside our platform. Start trading Waht is cfd free demo account, waht is cfd. Quick link to content:. CFD meaning The meaning of CFD is 'contract for difference', which is a contract between an investor and an investment bank or spread betting firm, usually in the short-term. What are contracts for difference?

How does CFD trading work? What is margin and leverage? What are the costs of CFD trading? Start with a live account Practise with virtual funds on a demo. What instruments can I trade? Short-selling CFDs in a falling market CFD trading enables you to sell short an instrument if waht is cfd believe it will fall in value, waht is cfd, with the aim of profiting from the predicted downward price move.

Practise CFD trading on the go. Open a demo account Learn more. FCA regulated. Segregated funds. Learn more Includes free demo account.

Equities vs CFDs: What’s the Difference?

, time: 5:43Computational fluid dynamics - Wikipedia

Computational fluid dynamics (CFD) is a branch of fluid mechanics that uses numerical analysis and data structures to analyze and solve problems that involve fluid flows A CFD trade is a contract between an investor and a broker to settle on the difference in the value of a financial asset or instrument for the duration of the contract. At the time of closing the contract (a trade), if the price is higher than the opening price, there will be 8/19/ · A contract for differences (CFD) is an agreement between an investor and a CFD broker to exchange the difference in the value of a financial product (securities or derivatives) between the time the Occupation: Trader And Trading Educator

No comments:

Post a Comment