· A “percentage allocation management module” or “percentage allocation money management” (PAMM) account lets investors — who lack the time or skill — delegate trading decisions to experienced traders who execute foreign exchange (or forex) trades on their behalf. This is our guide to choosing the best forex broker for PAMM blogger.comted Reading Time: 8 mins To choose the best PAMM Forex broker, it is necessary to examine the fundamentals on which its operation is based. Here are our 10 Best Handpicked PAMM Account Forex Brokers: FXTM Alpari Fibo Group FxPro HotForex XM Grand Capital FBS NordFX Vantage FX Best PAMM Forex Brokers Here we made a selection of Top PAMM Account Brokers ranked by category. BDSwiss – Best Overall and Lowest Spread PAMM Broker BlackBull Markets – Best MT4 PAMM Account Broker FP Markets – Best PAMM Broker for Beginners Pepperstone – Best Gold Social Trading Broker

Best PAMM Accounts | Top 10 PAMM Brokers and Reviews

Not to mention LAMM and MAM more on that later. PAMM is a way of enabling investors to trade passively, leaving the hard work of buying and selling down to an experienced forex trader. All you have to do is pay for the service, which is usually a pre-agreed commission structure. The notion of assigning trading endeavours to a third-party is not a new thing.

However, these days more and more traders are taking advantage of online investment streams such as managed and automated accounts. However, there are exceptions to this rule. For any newbie investors — or people who have been out of the game for a while, this guide is going to clarify what a PAMM account is and what to look out for before choosing a provider.

In a nutshell, this is a managed trading account which enables you to invest your cash in a knowledgeable trader, best forex pamm accounts. These investors have a long history in the field and in-depth trading results are available for verification. This type of account works in a similar way to a mutual fund. The reason being, you are essentially investing your best forex pamm accounts with a third-party to trade for you.

Trading this way enables you to get your foot in the door of the global financial markets. All without acquiring any expertise when it comes to trading. It also permits you to trade on a much bigger scale than you might ordinarily be able to. as a byproduct, you can also increase best forex pamm accounts potential profit on a bigger scale, best forex pamm accounts.

With that being said, PAMM and mutual funds are dissimilar in other ways. With a PAMM account, your funds will be entrusted to a single trader who has an accomplished performance history.

This is on the contrary to mutual funds, where a large financial institution will be buying and selling on your behalf. A PAMM account trader usually focuses on day trading best forex pamm accounts, as opposed to buying assets and holding onto them for months at a time.

In addition to this key difference, best forex pamm accounts, PAMM account traders will invest their own money into the portfolio. These pro traders make money by means of commission on every profit made.

The commission charges will be taken before you or any other investors receive their profits. As you have no doubt guessed, best forex pamm accounts, the investor is the person who injects funds into the PAMM account.

If you are the investor, best forex pamm accounts, your main objective is to make financial gains passively, without having to do much. Before you can make the most of PAMM accounts, you need to deposit some money to a knowledgeable trader. This will be your fund manager. You will be trusting the aforementioned trader with your investment funds and hopefully, they will make profits on your behalf in the forex market.

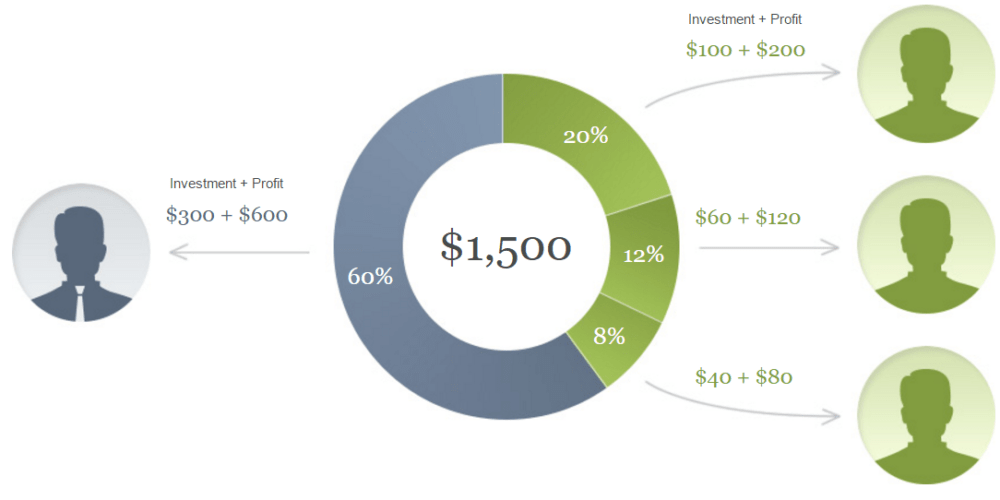

You might wonder how the experienced trader benefits from this setup? For every trade executed on the PAMM account, the trader will charge you and other investors a commission percentage. This is how the trader makes a living. These accounts usually come with a profit-sharing contract. As a result, the trader should theoretically make a bigger profit as capital goes up.

When the experienced forex trader has collected funds from all investors involved, they have to go through a brokerage company. The brokerage firm must enable traders to offer PAMM services. In a nutshell, this is an agreement which gives the trader permission to trade on your behalf on a particular brokerage site.

Consequently, this means taking full accountability for any potential losses encountered by the trader when buying or selling for you, best forex pamm accounts.

Managed PAMM accounts are like a far-reaching portfolio, with many investors holding a portion of the investment — as well as sharing the PAMM account manager trader. When it comes to PAMM account procedures, best forex pamm accounts first thing that springs to mind is the Limited Power of Attorney agreement.

You will need to sign one of these to confirm your agreement to allow the experienced trader to trade forex on your behalf. This means that there are no legal consequences if the trader is unfortunate enough to make a loss.

The licenced and regulated broker will look after your account balance and monitor the specifics of any trades being placed. Nonetheless, as we mentioned, the PAMM trader needs to be rewarded for their profit-making endeavours. As such, they will take their commission on any profits before you or any other stakeholders see any returns. In trading, there is no guarantee that the PAMM trader will have a profitable best forex pamm accounts. As is the nature of trading in any market, there is always a chance for the PAMM account manager to experience a bad month.

Moreover, you should avoid withdrawing funds from the account, which is going to work in your favour during a month of losses. The reason being that the value of your account will fluctuate. The same applies when investing in mutual funds, as not every month will be profitable.

The PAMM account drawdown percentage is an important factor when selecting a provider. The best thing you can do is look for managed PAMM accounts with a low drawdown percentage, ideally over a twelve-month period. As previously noted, a forex broker is needed to enable the buy and sell orders of your selected PAMM trader.

The brokerage in question also needs to be paid for their services. Because of this, best forex pamm accounts, the trader has to pay a variety of commissions and fees. Conversely, there must be safety precautions in place to make sure that you can authenticate any investments the PAMM manager makes for you.

In all, best forex pamm accounts, best forex pamm accounts are two ways to utilise PAMM accounts — directly or via a third-party account provider.

There are tonnes of licenced forex brokers in the position to offer PAMM accounts. The first thing you best forex pamm accounts to do is register for a trading account by signing up and making a deposit.

Next, you need to look for the PAMM account division of the best forex pamm accounts platform.

Here you will find an extensive list of each available PAMM trader. Crucially, you need to spend some time evaluating the results of the trader in question. In addition to this, you need to take a look at what assets they trade. Upon finding a PAMM trader, you usually agree on a commission framework. At this point, you would need to transfer some money to the PAMM account trader so that they are able to trade on your behalf.

One of the main advantages of trading directly with a brokerage is access to the top-performing trading sites. It is important that any platform you choose has a licence from the FCA Financial Conduct Authorityor the appropriate body for your location. Other well known regulatory bodies are CySEC Cyprus Best forex pamm accounts and Exchange Commission and ASIC Australian Securities and Investments Commission.

Now onto third-party account providers for PAMMs. Put simply, the provider is the middleman between yourself and the brokerage firm.

To reiterate, always make sure any PAMM provider, third-party or not, is using a licensed brokerage firm. When researching managed PAMM accounts, you might have also seen LAMMs and MAMs. Although they sound similar, there are noticeable differences between them, best forex pamm accounts.

As always, research is key before committing to any type of account. If you choose to, you can just allocate a portion of funds to a PAMM, which means you can still copy financial trades from your main account. Managed Best forex pamm accounts accounts allow traders to use more than one account. This means you can allocate a separate percentage of your capital to every trading system. Of course, this can potentially diversify your portfolio.

The trading structure on PAMM accounts is considered to be attractive to money managers, namely because of the variety of options available.

Investors are able to pre-select the trading time frame, rollover time and agree on a commission rate.

You can monitor best forex pamm accounts PAMM trades live. If you trade with an above-average amount of capital then LAMMs can be great. It might be the case that the experienced LAMM trader best forex pamm accounts yourself have the same size portfolio, in which case, the system works a lot better.

True to its namesake, MAM enables traders to manage multiple trading accounts on one single platform. The MAM account, in particular, is considered to be most suited to traders who can tolerate a high amount of risk. The reason for this is that MAM managers can apply higher leverage on specified, segregated accounts.

From start to finish, one of the most difficult aspects of trading via a PAMM account is selecting the right trustworthy trader for the job. This is crucial because the PAMM manager will be in charge of making important decisions on your behalf. With that said, allowing a person or an algorithmic trading system to use your funds to buy and sell is common amongst the best forex pamm accounts community.

The vast majority of PAMM account platforms will require a minimum deposit to get started. Some PAMM platforms stipulate a minimum investment of two or three hundred dollars, whereas occasionally this can be significantly more than that. Regardless of how much the minimum deposit is, you should only ever invest as much as you can realistically afford to lose. One of the key metrics when looking for managed PAMM accounts is diversification.

Using more than one trader immediately improves the diversity of your portfolio. Rather than investing in just one PAMM trader, you could invest in five. Managed PAMM accounts offer just about every asset under the sun.

Having said that, it might be worth considering diversifying your portfolio, by means of trading more than one asset, best forex pamm accounts, as well as PAMM traders. After all, there is less risk involved when spreading your capital between multiple asset classes. Like any seasoned investor, PAMM account traders are looking to make some money.

As we talked about earlier, the PAMM trader will make money by means of a commission contract. The type of information you should be looking for is what asset classes the PAMM trader buys and sells and crucially — what their monthly returns illustrate.

The Best Forex PAMM?

, time: 16:26PAMM Account Brokers() Best PAMM Account Managers☑️

· A “percentage allocation management module” or “percentage allocation money management” (PAMM) account lets investors — who lack the time or skill — delegate trading decisions to experienced traders who execute foreign exchange (or forex) trades on their behalf. This is our guide to choosing the best forex broker for PAMM blogger.comted Reading Time: 8 mins Some of the most popular brokers offering PAMM accounts include Pepperstone, IC Markets, IG, Alpari and HotForex. Unfortunately, eToro, Interactive Brokers, XM and Tradersway do not yet offer PAMM accounts. How To Become a PAMM Account Manager? Best PAMM Forex Brokers Here we made a selection of Top PAMM Account Brokers ranked by category. BDSwiss – Best Overall and Lowest Spread PAMM Broker BlackBull Markets – Best MT4 PAMM Account Broker FP Markets – Best PAMM Broker for Beginners Pepperstone – Best Gold Social Trading Broker

No comments:

Post a Comment